Bringing Opportunistic Commodity-focused exposure to Institutional Investors

At IDX we are focused on developing Risk-Managed Solutions that make it simple for fiduciaries and investors to participate in commodities beyond what’s available through traditional managed futures or long-only commodities funds.

IDX combines expertise across the managed futures and ETF landscape to deliver institutional investors risk-managed exposure that is focused on commodities with an ability to go short as well as opportunistically participate across asset classes.

The IDX Commodity Opportunities Fund (COIDX) seeks to tactically allocate to futures and ETFs, using a rules-based approach, in an effort to capture trends across asset classes (with a focus on commodities).

The IDX Commodity Opportunities Fund (COIDX) seeks to deliver a superior risk/return profile relative to long-only (passive) commodity exposure.

Unlike managed futures funds, the IDX Commodity Opportunities Fund (COIDX) can utilize ETFs to participate capture trends across a broader ecosystem of exposure (i.e. Miners, Oil Services) as well as entire industries not captured by the futures markets (i.e. CleanTech, AgTech)

Most investors think of Commodities as a single long-only allocation to a fund. In most cases, commodities funds are weighted by open interest and therefore heavily skewed towards a long energy exposure.

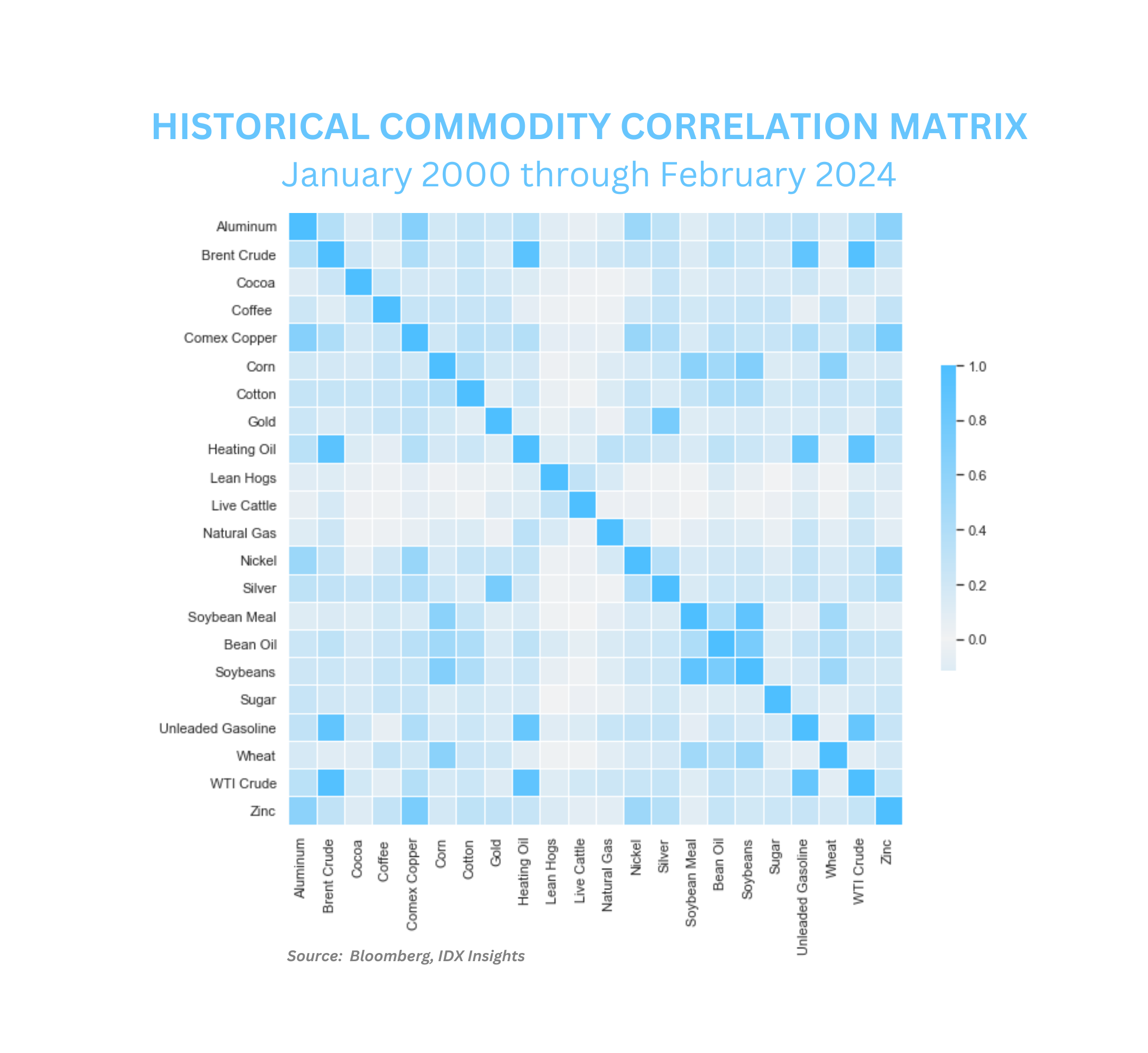

The reality, however, is that the commodities markets are very different and reflect nuanced and, often opposing, outlooks. Precious metals, for example, may respond strongly to geo-political risks and interest rate movements, while Grains are moving in a completely opposite direction based on drought forecasts.

We believe that investors that are serious about commodities exposures in their portfolios should consider a long/short approach. The global commodities markets represent a diverse and multi-faceted ecosystem that have different drivers of returns that can move very differently based on market conditions. We believe investors’ approach should reflect this reality.

Commodities have long been an important source of return within institutional portfolios. Over the last decade, generationally low interest rates and inflation combined with quantitative easing have caused investors to chase increasingly speculative or growth-oriented investments. The issue remains that commodities have always been a volatile asset class. IDX seeks to harvest that volatility as a source of return for investors by tactically establishing both long and short exposures that seek to take advantage of trends across all environments.

We began managing commodities exposure in the form of Separately Managed Accounts in 2019 with a dedicated focus on Risk-Mitigation. Commodities are a powerful asset class for investors, particularly during periods of non-zero inflation and increased geo-political risks. That said, the volatility and large drawdowns of the asset class are a stumbling block for many investors. By taking an opportunistic long/short approach to commodities, IDX seeks to provide investors with a commodity-focused exposure that can make money in any environment.

Futures contracts have largely remained unchanged since the 70’s while all of the innovation in providing exposures has been in the ETF landscape. By moving outside just futures contracts, the IDX Commodity Opportunities Fund can participate in trends within the commodities ecosystem that extend beyond just the raw material (such as Oil Services or Miners) as well as entirely new parts of the ecosystem that have no futures representation at all (such as “CleanTech” or “AgriBusiness”).

Distributed by Foreside Fund Services, LLC which is not affiliated with IDX Funds or IDX Advisors LLC. There are risks involved with investing including the possible loss of principal. Diversification does not guarantee investment returns or eliminate the risk of loss. Past performance does not guarantee future results. Investors should carefully consider the investment objectives, risks, charges and expenses of the fund before investing. To obtain a prospectus containing this and other important information, please visit the fund page to download a prospectus online or here. Read the fund’s prospectus carefully before you invest.

The BTIDX Fund actively invests in bitcoin futures contracts and other instruments that provide exposure to bitcoin futures. The Fund is a new mutual fund and has a limited history of operations for investors to evaluate. Additional risks associated with the Fund include, but are not limited to: Futures Risk: The Fund’s use of futures involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Investments in futures involve leverage, which means a small percentage of assets invested in futures can have a disproportionately large impact on the Fund. Concentration Risk: The Fund is concentrated in the Bitcoin industry. The Fund’s concentrated investment exposure involves risks different from, or possibly greater than, the risks associated with investing in a fund with exposure to a broader range of industries. The concentration risk of the Fund includes, but is not limited to, the potential for greater volatility and the potential for greater loss of investment capital than a diversified fund. The Fund may be susceptible to financial, economic, political or market events, as well as government regulation, impacting the Bitcoin industry. Fluctuations in the price of Cryptocurrencies, specifically Bitcoin and Bitcoin industry companies, often dramatically affects the profitability of the Bitcoin Industry and therefore potentially the Fund. Cryptocurrency Risk: Cryptocurrency (notably, Bitcoin), often referred to as “virtual currency” or “digital currency,” operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. The Fund may have concentrated exposure to Bitcoin, a cryptocurrency, indirectly through an investment in CME Bitcoin Futures and vehicles that the fund’s manager, in its sole and absolute discretion, determines to be Bitcoin Industry companies or investments. Cryptocurrencies operate without central authority or banks and are not backed by any government.

The COIDX Fund is a new mutual fund and has a limited history of operations for investors to evaluate. Additional risks associated with the Fund include, but are not limited to: Investment Concentration Risk: The Fund is concentrated in Commodity Futures and Commodity Industry companies. The Fund’s concentrated investment exposure involves risks different from, or possibly greater than, the risks associated with investing in a fund with exposure to a broader range of industries. The concentration risk of the Fund includes, but is not limited to, the potential for greater volatility and the potential for greater loss of investment capital than a diversified fund. The Fund may be susceptible to financial, economic, political or market events, as well as government regulation, impacting the Commodity industry. Fluctuations in the price of Commodities often dramatically affects the profitability of the Commodities Industry and therefore potentially the Fund. Futures Risk: The Fund’s use of futures involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Investments in futures involve leverage, which means a small percentage of assets invested in futures can have a disproportionately large impact on the Fund.

Other risks associated with investing in the funds include: Geographic Concentration Risk: The Funds may be particularly susceptible to economic, political, regulatory or other events or conditions affecting countries within the specific geographic regions in which the Fund invests. Liquidity Risk: Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations. Leverage Risk: The value of your investment may be more volatile if the Fund borrows or uses instruments, such as derivatives, that have a leveraging effect on the Fund’s portfolio. Equity Market Risk: Equity markets can be volatile, and the prices of common stocks can fluctuate significantly. Derivatives Risk: The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Foreign Investment Risk: Foreign investing involves risks not typically associated with U.S. investments, including adverse fluctuations in foreign currency values, adverse political, social and economic developments, less liquidity, greater volatility, less developed or less efficient trading markets, political instability and differing auditing and legal standards. Portfolio Turnover Risk: The frequency of the Funds transactions will vary from year to year. Higher costs associated with increased portfolio turnover may offset gains in a Funds performance. ETF Risk: ETFs are subject to investment advisory fees and other expenses, which will be indirectly paid by the Fund. As a result, your cost of investing in the Fund will be higher than the cost of investing directly in ETFs and may be higher than other mutual funds that invest directly in stocks and bonds. ETFs are listed on national stock exchanges and are traded like stocks listed on an exchange. Model and Data Risk: Given the complexity of the investments and strategies of the Fund, the adviser relies heavily on quantitative models and information and data both proprietary as well as supplied by third parties (“Models and Data”). Models and Data are used to rank securities and derivatives, provide risk management insights, and to assist in managing the Fund’s investments.